Last Review: July, 2025

Banobras offers interested parties information on the sector in Mexico with data from various sources in order to provide knowledge and useful elements for decision-making on the subject. The content presented does not reflect the position of Banobras.

The Ministry of Energy launches a new phase of service: it invites stakeholders to ratify procedures before the National Energy Commission (CNE) and makes the Energy One-Stop Window available. Consult.

Agreement amending the Operating Rules of the Assignments, Contracts, and Permits Committee of the Ministry of Energy. Consult.

Current status

The Strengthening and Expansion Plan for the National Electric System (2025-2030) foresees a total investment of approximately MXN 624.6 billion. On April 9, 2025, the Government of Mexico announced that, as part of the electricity sector initiatives, 29,000 MW of capacity will be added, with CFE providing reliability and firm energy, while private entities will support the energy transition.

Generation

- Investment: MXN 424.6 billion

- 2030 Target: Add 22,674 MW to public electricity generation capacity

- Total Capacity: 29,074 MW (CFE + Private)

- 76 projects

- 7 projects to be tendered between April and December 2025, aiming for operations between 2028 and 2029:

- Francisco Pérez Ríos Combined Cycle Plant (CCC): USD 827 million (tender April 2)

- Salamanca II CCC: USD 537 million (tender April 23)

- Altamira CCC: USD 424 million (tender May 14)

- Los Cabos Internal Combustion Plant (CCI): USD 272 million (tender June 11)

- Mazatlán CCC: USD 529 million (tender July 2)

- Puerto Peñasco Solar Plant Phase II (CFV): USD 270 million (tender August 12)

- Puerto Peñasco Solar Plant Phase IV (CFV): USD 252 million (tender August 21))

Wind power plant, Juchitán, Oaxaca Comisión Federal de Electricidad..

Transmission

- Investment: MXN 124.5 billion

- 2030 Target: 158 projects to strengthen the National Transmission Network (RNT) with 15,729 MVA

- 77 new transmission projects to be tendered, including 9 in 2025 (in Jalisco, Coahuila, Sinaloa, Chihuahua, Tamaulipas, Nuevo León, Baja California, and Guanajuato)

Distribution

- Monto: Investment: MXN 72.5 billion

- 2030 Target: 97 new substations, 95 substation expansions, 6,875 network modernization projects and 42,221 electrification projects

Private Sector Participation Schemes

Six schemes are planned for private sector participation:

- Three for self-consumption:

- Distributed energy generation (residential and commercial) from 0.5 to 0.7 MW

- Isolated self-consumption (0.7 to 20 MW)

- Interconnected self-consumption up to 0.7 MW.

- Three for energy generation:

- Long-term production contracts delivering energy to CFE, with potential asset transfer to CFE at the end.

- Mixed investment generation, maintaining 54% CFE participation, sharing risks and benefits.

- Maintaining the figure of independent power producers for sales in the wholesale electricity market.

Alignment with PRODESEN 2024-2038

CFE’s planning aligns with the National Electric System Development Program (PRODESEN) 2024-2038 , the Government of Mexico’s public policy instrument outlining a 15-year horizon for objectives, strategies, and priorities to meet energy demand. PRODESEN focuses on recovering CFE’s generation, transmission, distribution, and supply capacity.

According to the Electric Industry Law (Article 3), the industry comprises:

- Generation: Production of electricity from various sources, including renewables.

- Transmission: Transport via high-voltage networks.

- Distribution: Delivery from transmission networks to end users.

- Commercialization: Sale of electricity to residential and industrial consumers.

Energy Demand

In 2023, net electricity consumption grew by 3.5% compared to 2022, surpassing long-term projections. Expected annual growth rates for 2024-2028 are: 2.4% (base scenario), 2.9% (high scenario) and 2.1% (low scenario).[1]

Energy Generation

Total generation in 2023 reached 351,695 GWh, with 24.32% from clean energy sources. By generator: CFE: 41.9%, Independent Power Producers (IPPs): 29.7%, Private entities: 27.7%. A net generation of 525,151 GWh is projected by 2038, with plans to incorporate green hydrogen from 2035 to accelerate the energy transition and reduce natural gas use in combined cycle plants.[2]

Transmission and Distribution

The National Transmission Network (RNT) transports electricity to the General Distribution Networks (RGD) and the public, including 12 international connections, operating at 69 kV or higher. The RGD distributes energy via medium voltage (1 kV to 35 kV) and low voltage (1 kV or less) networks.

The RNT Length: 111,144 km with 337,998 towers nationwide.

Energy losses in RNT and RGD were 12.2% in 2023, with projections to reduce to 10.8% in 2024 and 7.9% by 2038. Electrical coverage reached 99.43% of the population in 2023, with 743,685 people still lacking access. In 2023, 4,648 electrification projects were carried out, with an investment of MXN 3.3 billion.[3]

Installed Capacity

In 2023, installed generation capacity was 87,1360 MW: CFE: 51.3%, IPPs: 19.10% and private: 30.7%

By 2038, capacity is projected to reach 176,516 MW, with a net addition of 84,194 MW between 2024-2038, including 31,739 MW from clean energy by 2030 and a transition to natural gas and green hydrogen in combined cycle plants..[4]

For more sector information, the Energy Information System (SIE)* offers a database maintained by Mexico’s energy agencies and the Ministry of Energy, responsible for national energy policy. This portal provides validated official statistics (registration required for access).*

[1] Prodesen 2024-2038 page 96

[2] Prodesen 2024-2038 page 202

[3] Prodesen 2024-2038 page 69

[4] Prodesen 2024-2038 page 96

The National Center for Humanities, Science and Technology (CONAHCYT) makes available to interested persons the Map of the National Electric System. The map shows the operating power plants of the SEN by type of technology and the National Transmission Network. It is possible to visualize the information of each power plant by clicking on the point that represents it:

Institutional Arrangement

In terms of infrastructure, Mexico has a defined strategy that offers investors medium and long-term visibility regarding the development of projects, through a series of plans and programs of national and sectorial scope. To access the information, please consult the following documents:

National Electric Power System Development Program 2024-2038

Energy Sector Program 2020-2024

Organizational Structure

Description of the hierarchy and roles of the different entities and actors involved in the sector, including how the different institutions and agencies coordinate and collaborate.

The Ministry of Energy is the Federal Government entity responsible for controlling, managing and regulating Mexico’s energy resources, and establishing the national energy policy.

The Energy Project Monitoring Window, also known as Ventanilla Energía, is a digital platform developed by Mexico’s Ministry of Energy (SENER) to facilitate the management and monitoring of energy projects. This platform aims to provide greater transparency, traceability, and certainty for initiatives within the energy sector.

Undersecretary of Electricity

Unit that designs and executes the electricity policy, within the applicable legal framework, to contribute to the growth of the national electric sector. This unit establishes programs, projects and policies related to the sector.

The National Energy Commission is a technical body under the jurisdiction of the Ministry of Energy. Its purpose is to regulate, supervise, and enforce compliance in energy-related activities, with the aim of promoting the orderly, continuous, and safe development of the energy sector, in accordance with binding planning within its scope of authority.

On June 5, 2025, the AGREEMENT was published by which the deadlines and timeframes for the receipt and processing of matters under the jurisdiction of the National Energy Commission are resumed, in accordance with the powers that were granted and transferred to it, and which establishes the strategy for addressing them.

Decentralized public agency of SENER whose purpose is to exercise operational control of the National Electric System, the operation of the wholesale electricity market and guarantee fairness in access to the National Transmission Network (RNT) and the General Distribution Networks (RGD). It also formulates expansion and modernization programs for the RNT and RGD, which are incorporated into PRODESEN, once authorized by SENER.

Its purpose is to ensure continuity and security in the provision of services nationwide and to guarantee the efficient transportation of natural gas, which is essential for electricity generation.

Its objective is to explore, exploit, benefit and take advantage of lithium located in national territory, as well as the administration and control of the economic value chains of said mineral.

Decentralized public entity acting as a research center to provide solutions to the needs of the power sector. Its mission is to support and stimulate the future power systems through innovation projects and technological development

Specializes in nuclear technologies for applications in medicine, industry, agriculture and power generation.

Public trust whose objective is to assist localities with power supply shortage. The trust is chaired by the Undersecretary of Electricity, and its operation is under control of the Generation, Distribution and Commercialization of Electric Power and Social Linking Direction (SENER)

Its purpose is to promote energy efficiency and constitute itself as a technical body for the sustainable use of energy.

It is responsible for responding to international commitments and requirements in the areas of nuclear, radiological and physical security, as well as safeguards.

It is the country’s main producer and supplier of energy. As part of its public mandate, it must provide the public service of electricity transmission and distribution on behalf of and under the authority of the Mexican State, as well as carry out power generation through separate units and the commercialization of electricity and associated products, including their import and export. Additionally, it engages in the import, export, transportation, storage, purchase, and sale of natural gas, coal, and any other fuel, along with all other activities necessary for the full execution of its mandate.

On October 31, 2024, a decree was signed reestablishing CFE as a State-Owned Enterprise, following the approval of the energy reform by the Chamber of Deputies, the Senate, and a majority of state congresses. As a result of the reform, the “National Electricity Sector Strategy” was introduced, structured around four guiding pillars aimed at strengthening the national electricity sector’s planning and development:

- Strengthening the planning of the National Electricity Sector: The State regains leadership over energy policy, ensuring energy sovereignty and electricity supply for businesses, while promoting equitable, inclusive, and comprehensive development for all.

- Energy justice: Contributes to social well-being by maintaining stable electricity tariffs and expanding service to households currently without access.

- A robust, reliable, and secure electricity system: CFE is implementing a Reliability Plan to ensure the safe, continuous, and dependable operation of the National Electric System. Investment of USD 23.4 billion is planned through 2030.

- Investment certainty for the private sector: Private participation in the sector will follow clear regulations, maintaining a 46% share in electricity generation.

Legal system

The compilation of international treaties, laws, regulations, decrees, agreements, and federal, state, and municipal provisions presented here are for informational purposes and intended to facilitate their consultation:

SENER / CFE

Public Works and Related Services Law

Electricity Sector Law

State-Owned Enterprise Law – Federal Electricity Commission (CFE)

Planning and Energy Transition Law

National Energy Commission Law

Electricity Industry Law

Geothermal Energy Law

Source: Prodesen 2024-2038

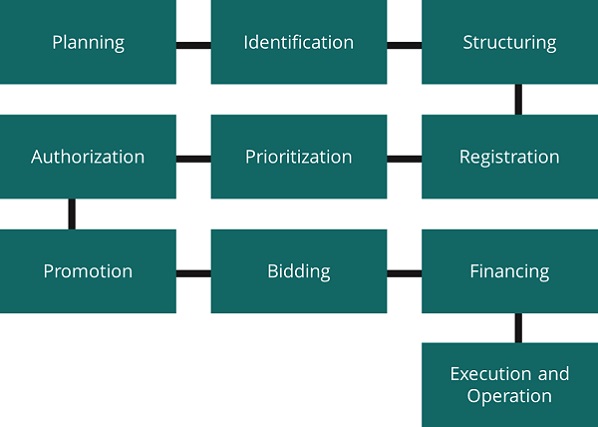

Investment cycle

The following section provides an overview of the project development process from initial planning to final execution.

Planning

The Ministry of Energy (SENER) leads sector planning based on three key inputs: a) the National Development Plan 2025–2030, which sets goals for energy sovereignty and transition; b) the PRODESEN 2024–2038 (National Electric System Development Program), which details the expansion plans for the National Transmission Grid (RNT) and the General Distribution Grids (RGD); and c) the CFE Business Plan 2024–2028, which aligns the public utility’s investments with the PRODESEN. The National Energy Commission (CNE) participates as a technical and regulatory body, issuing rulings on consistency with energy policy.

Identification

Using the planning documents, the Ministry of Energy (SENER), the Federal Electricity Commission (CFE), and the National Center for Energy Control (CENACE)—with technical assistance from the National Energy Commission (CNE)—identify the generation, transmission, and distribution projects required to meet demand growth and reliability objectives.

Structuring

The Federal Electricity Commission (CFE) prepares technical, economic, and environmental studies either independently or with the support of external consultants; the National Energy Commission (CNE) issues regulatory and interconnection guidelines. For joint investment projects, co-investment schemes and long-term production contracts are included.

Registration

Projects with federal funding: The Federal Electricity Commission (CFE) submits the registration request to the Investment Unit of the Ministry of Finance and Public Credit (SHCP); the National Energy Commission (CNE) supports the file with its technical opinion.

Private projects: The project owner registers the initiative directly with the CNE, a prerequisite for any permit.

Prioritization

The Ministry of Energy (SENER) prioritizes the projects to be included in the Federal Expenditure Budget (PEF), based on cost-benefit analyses prepared by the Federal Electricity Commission (CFE) and feasibility assessments issued by the National Energy Commission (CNE).

Authorization

The CNE grants or denies permits for generation, transmission, distribution, and supply; it also regulates rates and open access conditions. The CFE’s Investment Projects and Programs (PPI) process includes: integration into the Planning Mechanism, individual analysis, and approval by the Investment Committee / Board of Directors.

Promotion

SENER and CFE promote investment opportunities (auctions, long-term contracts, co-investments) at national and international forums. The CNE publishes regulatory guides and technical sheets to support the bankability of the projects.

Bidding

It is led by the Federal Electricity Commission (CFE), following the technical guidelines issued by the Ministry of Energy (SENER) and the fiscal and economic conditions established by the Ministry of Finance and Public Credit (SHCP). The terms of reference can be consulted on the CFE website.

Financing

Various financing sources are available depending on the specific characteristics and financial structure of each project. These include federal funds or resources from the Federal Expenditure Budget (PEF), as well as funding from development banks, commercial banks, institutional and private developers, FIBRA E, and institutional investors.

Execution and Operation

Awarded operators carry out and commission the works under the technical and regulatory supervision of the National Energy Commission (CNE). CFE monitors contractual performance, while SENER ensures alignment with energy policy. Progress indicators are reported to the PRODESEN (Program for the Development of the National Electric System) and to CFE’s Board of Directors.

Projects

Information on new projects (pre-investment, bidding and execution) and in operation within the Mexico Projects Hub platform, which at some stage of the project were considered investment opportunities and do not necessarily have Banobras / Fonadin participation.

New Projects

Projects in Operation

Strategic Projects

Banobras / Fonadin

Project Finance: In order to support the financing of infrastructure projects and public services, the Project Finance Unit structures financing supported by the granting of loans and guarantees to those projects developed as Public-Private Partnerships and which have their own source of payment from the exploitation of the concession or public contract or from the collection of the service in question. The Public-Private Partnership schemes may be Federal and/or Local, in their different modalities, such as: Concessions, Service Provision Projects (PPS) or Financed Public Works Contracts, among others.- The Platform has more than 600 investment opportunities in all its stages, with visits from more than 180 countries and more than 40,000 users per month.

Financing for States and Municipalities and Decentralized Public Organizations: The products and services are designed to meet the infrastructure needs of states, municipalities and their decentralized public organizations, in order to improve the quality of life of the population and increase competitiveness.

Infrastructure is a pillar of development, which is why Banobras has innovative products and services focused on contributing to regional development through the promotion of financial mechanisms to:

Boost investment in infrastructure and public services.

Promote the financial and institutional strengthening of states, municipalities and decentralized public agencies.

To this end, Banobras has the following financing schemes:

Products:

Project Development: Banobras offers services aimed at assisting public sector agencies and entities in the development of infrastructure projects.

Financial structuring of the project:

- Elaborate and/or update studies required by the Public-Private Partnerships Law.

- Support in the review of the bidding conditions and contract model.

- Assist in obtaining financing for the project.

- Assist in the registration process of the project in the portfolio of the Investment Unit of the Ministry of Finance and Public Credit (SHCP).

- Assist in dealing with any observations made by the SHCP Investment Unit.

- Support in the financial closing of the project.

The purpose of the Fondo Nacional de Infraestructura (Fonadin) is to serve as the Federal Public Administration’s coordination vehicle for infrastructure investment. It has one of the largest road concession networks in the world and manages the granting of financial support for infrastructure development, mainly in the areas of communications, transportation, water, environment, energy, tourism, urban and strategic and priority areas, supporting the planning, promotion, construction, conservation, operation and transfer of infrastructure projects with social impact and economic or financial profitability.

It has a wide range of products designed to strengthen the financial structure of the infrastructure projects that the country requires, from the conception to the completion of the projects, providing the following financial instruments that make the projects more attractive for financing with private resources:

Recoverable Support

- Simple Credits

- Subordinated Credits

- Guarantees

- Investments in Venture Capital Funds

- Infrastructure Trust Investments

- Financing of Studies and Advisory Services

Non Recoverable Support

- Contributions for Studies and Consultancy

- Contributions for Projects

- Project Grants

Contact: fonadin.energia@banobras.gob.mx

Sustainability

Banobras makes available to interested parties, analysis sheets for the detection of sustainability practices in infrastructure projects, in accordance with the methodological framework “Attributes and Framework for Sustainable Infrastructure” of the Inter-American Development Bank (IDB). Its objective is to highlight sustainable practices, encourage their adoption in future projects and provide relevant information for investors in their economic, environmental, social and institutional dimensions.

To review the projects that already have a sustainability record, select the “SEARCH CRITERIA>” option in the PROJECTS section, and then select “With Sustainability Analysis” at the end of the criteria; the projects that have a record will be displayed below.

In addition, Banobras offers an analysis tool that presents the potential relationship of the different infrastructure projects of the Mexico Projects platform with the 17 Sustainable Development Goals (SDGs) of the 2030 Agenda and their targets. This comparative analysis facilitates the use of data according to different criteria, such as the potential impact of projects and sectors against national and global development goals.

The comparison is only made between projects in the same subsector. To select and consult here.

The alignment of a project with the SDGs provides information on the degree of focus on sustainability; it provides a comparison between projects in the same sector and sub-sector and facilitates investment decisions, showing the highest and lowest alignment of projects to the SDGs. Comparative analysis facilitates the use of data according to different criteria, such as the potential impact of projects and sectors against national and global development goals.

In the case of the sector, 40 projects are identified in the platform that have sustainability practices detection sheets, which allows to know, among other things, the projects with more and better alignments to the SDGs. For more information, access the Sustainable Development Goals application:

Greater alignment of the sector:

- SDG 9: Industry, Innovation, and Infrastructure

- SDG 11: Sustainable Cities and Communities

- SDG 7: Affordable and Clean Energy

Reduced alignment of the sector:

- SDG 14: Life Below Water

- SDG 5: Gender Equality

- SDG 17: Partnerships for the Goals

Ally Networks

Banobras, through its Ally Networks application, provides information on companies participating in competitive public procurement processes for infrastructure projects in Mexico, based on official sources such as ComprasMX. It includes details on investment amounts, number of participations in bids, projects awarded, consortiums, and business associations, which allows the user to identify potential actors for the establishment of investments in the country.

To consult the projects that have information on the participating companies, select the option “SEARCH CRITERIA>” in the PROJECTS section, and then select “With applicant companies” at the end of the criteria.

In the application, you can consult on the sector:

- 13 projects

- 51 companies

- 20 consortiums

Reference documents:

This section offers documents, reports and reports with technical, statistical and regulatory information on the sector:

Official statements:

2025

- June. 24, 2025 DOF: Agreement amending the Operating Rules of the Assignments, Contracts, and Permits Committee of the Ministry of Energy.

- June. 06, 2025 DOF: Organic Statute of the State-Owned Enterprise, Federal Electricity Commission.

- June.05, 2025 SENER: AGREEMENT by which the deadlines and timeframes for the reception and processing of matters under the jurisdiction of the National Energy Commission are resumed, in accordance with the powers that were granted and transferred to it, and which establishes the strategy for their handling.

- Apr. 29, 2025 SENER: Agreement by which the deadlines and timeframes for the receipt and processing of matters under the jurisdiction of the Ministry of Energy are resumed, in accordance with the powers that were transferred to it.

- Apr. 9, 2025 Ministry of Energy: The Government of Mexico presents the actions to be undertaken by the electricity sector to strengthen and accelerate the México Plan.

- Mar. 18, 2025 Official Gazette (DOF): DECREE issuing the Law on State-Owned Enterprises: Federal Electricity Commission; the Law on State-Owned Enterprises: Petróleos Mexicanos; the Electric Sector Law; the Hydrocarbons Sector Law; the Energy Planning and Transition Law; the Biofuels Law; the Geothermal Law; and the Law of the National Energy Commission. The decree also amends various provisions of the Mexican Petroleum Fund for Stabilization and Development Law, and reforms, adds, and repeals several provisions of the Organic Law of the Federal Public Administration.

- Feb. 5, 2025 Government of Mexico: The President presents 51 electricity projects under the 2025–2030 National Electric System Strengthening and Expansion Plan.

- Jan. 29, 2025 Ministry of Energy (SENER): Secondary Energy Legislation – PEMEX and CFE as the people’s companies of Mexico.

2024

- Government of Mexico: CFE and PEMEX return to the people of Mexico: President signs secondary laws that overturn the 2013 energy reform.

- Official Gazette (DOF): Decree amending, adding, and repealing various provisions of the Political Constitution of the United Mexican States on organizational simplification.

- Official Gazette (DOF): DECREE amending the fifth paragraph of Article 25, the sixth and seventh paragraphs of Article 27, and the fourth paragraph of Article 28 of the Political Constitution of the United Mexican States, concerning strategic areas and enterprises.

- CFE: 2024 National Electric Sector Strategy.