Last Review: February, 2026

Banobras offers interested parties information on the sector in Mexico with data from various sources in order to provide knowledge on the subject and useful elements for decision-making at the sectoral level. The content presented does not reflect the position of Banobras.

PRESIDENCY: Pemex increases crude oil processing to 1.5 million barrels per day; reduces debt by $20 billion and increases investment by 34% in 2026 (02/04/2026). View document

Current status

The National Strategy for the Hydrocarbons and Natural Gas Sector aims to continue strengthening the planning and regulation of the sector, ensuring strict compliance with national energy policy. The Petroleum Rights for Welfare is the new fiscal regime for Petróleos Mexicanos (PEMEX), set at 30% for oil and 11.3% for non-associated gas.

Key strategic lines for the 2024-2030 period include:

- Saving MXN 50 billion by eliminating redundant expenses.

- Integration into a single company, financial strengthening, increased productivity, and operational efficiency.

- Commitment to sustainability.

- Use of new exploration techniques in shallow waters of the Gulf of Mexico and onshore fields in southeastern Mexico to maintain, restore, and increase reserves for 10 years of consumption.

Source: SENER, Oil Platform, Campeche Sound, PEMEX

- Hydrocarbon production is projected to remain at 1.8 million barrels per day (bpd), prioritizing strategic fields such as Zama and Trion.

- Natural gas production is expected to increase to 5 billion cubic feet per day during the current administration.

- Refining capacity will grow by 343 thousand bpd (a 34% increase) in gasoline, diesel, and jet fuel production to achieve self-sufficiency.

- The Deer Park refinery aims to reach a processing level of 285 thousand bpd, while major maintenance works will continue across the National Refining System to ensure profitability across all refineries.

- Storage capacity for petroleum products will be expanded.

- Petrochemical production will be strengthened through joint projects ensuring PEMEX ownership.

- Production of ammonia and carbon dioxide for fertilizer manufacturing will increase by 2.2 million tons annually.

On January 29, 2025, secondary laws of the energy reform were presented, aiming to strengthen PEMEX and CFE as state-owned enterprises.

With these secondary laws, SENER will regain control over binding energy sector planning, and private subsidiaries within both companies will be dissolved (PEMEX previously had three subsidiaries and nearly 50 affiliates).

For the hydrocarbons sector, reforms aim to strengthen PEMEX, prioritizing exploration and extraction areas, and granting the option to partner with private entities through joint development contracts. Additionally, hydrocarbon traceability will be improved, mandating data reporting from fuel entry to gas station distribution.

Investment Schemes

For exploration and extraction, PEMEX will complement its traditional assignment model with joint development contracts, allowing the company to enhance its capabilities and financing.

PEMEX has achieved stabilization and growth of proven crude oil and gas reserves, progress in rehabilitating the National Refining System, construction of large-scale projects to increase crude processing capacity for gasoline, diesel, and jet fuel production, reactivation of fertilizer production chains, and gradual recovery of the national fuel market.

At the end of 2023, PEMEX reported a net profit of MXN 8.15 billion and an EBITDA of MXN 355.47 billion.

As of June 2024, PEMEX’s modified budget amounts to MXN 408.2 billion, allocated as follows:

- MXN 310.7 billion for oil and gas exploration and production

- MXN 79.4 billion for refining, gas, and petrochemical transformation

- MXN 15.4 billion for logistics

- MXN 2.7 billion for corporate operations[1]

Hydrocarbons

The hydrocarbons industry chain includes three main stages: Exploration and Production, Logistics, and Industrial Transformation: [2]

Exploration and Production (Upstream)

- Producing fields: 261

- Crude oil production: 1.936 million bpd

- Natural gas production: 1.823 billion cubic feet per day

- Average exploration wells: 5,553

- Offshore platforms: 304

Logistics (Midstream)

- Storage and dispatch terminals: 73

- LPG distribution terminals: 10

- Oil pipelines: 5,777 km

- Multiproduct pipelines: 8,926 km

- Fuel oil pipelines: 100 km

- Jet fuel pipelines: 66 km

Industrial Transformation (Downstream)

- Gas processing complexes: 9

- Refineries: 7

- Petrochemical complexes: 6

For more information on the sector, the Energy Information System (SIE)* responsible for national energy policy. This portal offers official statistical data validated by sector entities (registration required for access)*..

[1] Sixth Activity Report of the Ministry of Energy, 2023–2024.

[2] PEMEX Statistical Yearbook, 2022.

The National Hydrocarbons Commission makes available to the public the portal of technical information generated throughout Mexico’s oil history:*:

*Map under review due to changes in the organizational structure.

Institutional Arrangement

In terms of infrastructure, Mexico has a defined strategy that offers investors medium and long-term visibility regarding the development of projects, through a series of plans and programs of national and sectorial scope. To access the information, please consult the following documents:

Energy Sector Program 2025-2030

PEMEX: Strategic Plan 2025-2030

Five-Year Bidding Plan for Hydrocarbon Exploration and Extraction 2020-2024

PEMEX Business Plan and Subsidiaries 2023-2027

Five-year SISTRANGAS Expansion Plan 2020-2024

Organizational Structure

Description of the hierarchy and roles of the different entities and actors involved in the sector, including how the different institutions and agencies coordinate and collaborate.

The main task of the Ministry of Energy (SENER), an agency of the Federal Public Administration (APF), is to establish, conduct and coordinate the country’s energy policy, in addition to supervising its compliance with priority given to energy security and diversification.

The Energy Project Monitoring Window, also known as Ventanilla Energía, is a digital platform developed by Mexico’s Ministry of Energy (SENER) to facilitate the management and monitoring of energy projects. This platform aims to provide greater transparency, traceability, and certainty for initiatives within the energy sector.

To encourage the achievement of the objectives set in the National Development Plan, this unit establishes strategies and programs, and evaluates their impact within the framework of the Democratic National Planning System and the sectorial programs.

The National Energy Commission is a technical body under the jurisdiction of the Ministry of Energy. Its purpose is to regulate, supervise, and impose sanctions on energy-related activities, in order to promote their orderly, continuous, and safe development, in accordance with binding planning within its area of competence.

On June 5, 2025, the AGREEMENT was published by which the deadlines and timeframes for the receipt and processing of matters under the jurisdiction of the National Energy Commission are resumed, in accordance with the powers that were granted and transferred to it, and which establishes the strategy for addressing them.

A decentralized public body under SENER, aiming to ensure the reliable, efficient, and safe supply of natural gas throughout the country. It operates as a technical manager of the Integrated National Natural Gas Transport and Storage System (SISTRANGAS) and provides efficient natural gas transport services.

Decentralized organization of the SENER operating as a public research center, dedicated to both research and technological development required by the oil, petrochemical, and chemical industries, providing technical services to them, commercializing technological products and services resulting from research, and training specialized human resources in its areas of activity.

The Mexican Oil Fund for Stabilization and Development is a Public trust managed by the central bank, aligned with the SHCP. This fund receives, administrates, and distributes the revenues, except taxes, that the Federal Government collects from oil and gas exploration and extraction. Additionally, the fund determines the amounts to be paid under existing exploration and extraction contracts, transfers the funds, and invests the remaining resources

The Security, Energy and Environment Agency is a decentralized public entity from the Ministry of Environment and Natural Resources (SEMARNAT), with technical and managerial autonomy, responsible for regulating and supervising industrial and operational safety, as well as the protection of the environment in hydrocarbon related activities.

The ASEA Environmental Gazette is a document that contains information on Environmental Impact Statements (MIA), Preventive Reports (PI) and Unified Procedures that are evaluated by the Industrial Management Unit of the Safety, Energy and Environment Agency (ASEA).

PEMEX

A productive state-owned company, exclusively owned by the Federal Government, with its own legal standing and assets and enjoys technical, operational, and management autonomy. Its operations cover the entire production chain, from exploration and production to industrial transformation, logistics, and commercialization of hydrocarbons and derivatives.

A state-owned public company tasked with generating, transmitting, distributing, commercializing, and supplying primary inputs for the electric industry, as well as auxiliary and related activities. The Federal Government exclusively owns the CFE, which has its own legal standing, assets, and technical, operational, and management autonomy. It is a major participant in gas transportation.

Legal system

The compilation of international treaties, laws, regulations, decrees, agreements and federal, state and municipal provisions shown here are for informational purposes and for ease of reference:

- Energy

- PEMEX

- Public Works and Related Services Law

- Hydrocarbos Sector Law

- Regulations of the Hydrocarbons Sector Law

- State-Owned Enterprise Law – PEMEX

- Mexican Petroleum Fund for Stabilization and Development Law

- Biofuels Law

- Regulations of the Biofuels Law

- National Energy Commission Law

- Hydrocarbos Revenue Law

- Planning and Energy Transition Law

- Regulations of the Planning and Energy Transition Law

Source: Sixth Work Report, SENER. Vessel Kukulcan, Mexican Pacific, PEMEX.

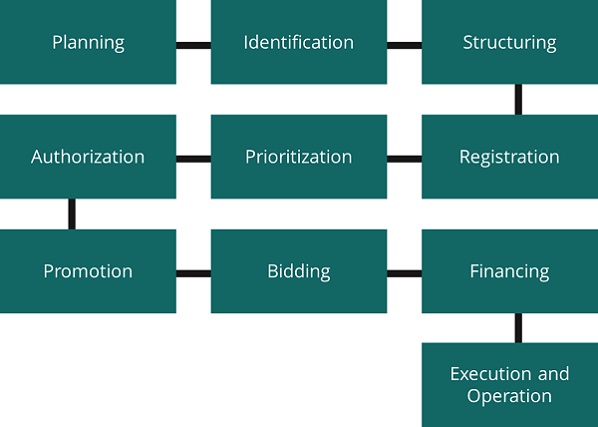

Investment cycle

The following section provides an overview of the project development process from initial planning to final execution.

Exploration and Production

Based on the objectives and strategies defined by the Ministry of Energy (Secretaría de Energía, SENER), sector planning is aligned with the Five-Year Plan for the Development of Hydrocarbon Exploration and Extraction Activities. This instrument, updated by SENER with the technical support of the National Energy Commission (Comisión Nacional de Energía, CNE), outlines areas with productive potential, tentative bidding schedules, and strategic guidelines for the efficient and sustainable use of resources.

Transportation and Logistics | Refining

In accordance with the Sectoral Energy Program (PROSENER) and other planning instruments, SENER establishes national priorities for hydrocarbon transportation, storage, distribution, and refining infrastructure. The National Energy Commission (CNE) acts as the technical regulatory body, issuing diagnostics, capacity assessments, and expansion needs that support sector planning and the definition of strategic projects.

Exploration and Production

Based on planning instruments, the Ministry of Energy (Secretaría de Energía, SENER), in coordination with Petróleos Mexicanos (PEMEX) and with technical support from the National Energy Commission (Comisión Nacional de Energía, CNE), identifies areas with exploration and extraction potential and defines the priority projects to be developed, either through direct assignment or bidding processes.

Transportation and Logistics

SENER, in coordination with the National Center for Natural Gas Control (Centro Nacional de Control del Gas Natural, CENAGAS), PEMEX, and the CNE, identifies the needs for expansion, modernization, or development of new infrastructure for the transportation, storage, and distribution of hydrocarbons. The CNE provides the technical, regulatory, and operational analyses that support the feasibility of such projects.

Refining

In line with the objectives established in sector development programs, SENER, in coordination with PEMEX and with technical support from the CNE, identifies the industrial transformation projects required to strengthen national refining capacity, optimize processes, and ensure the supply of petroleum products.

Exploration and Production

The Ministry of Energy (Secretaría de Energía, SENER), with the technical support of PEMEX Exploration and Production, prepares—either independently or with the assistance of external consultants—the studies and analyses required for project development. The National Energy Commission (Comisión Nacional de Energía, CNE) may participate by issuing technical guidelines and regulatory criteria applicable to the development of such projects.

Transportation and Logistics

SENER, with the technical support of the CNE, PEMEX Logistics, and the National Center for Natural Gas Control (Centro Nacional de Control del Gas Natural, CENAGAS), prepares—either independently or with the assistance of external consultants—the studies and analyses required for project development.

Refining

SENER, with the technical support of PEMEX Industrial Transformation and the CNE, prepares—either independently or with the assistance of external consultants—the studies and analyses required for project development.

Exploration and Production

The Ministry of Energy (Secretaría de Energía, SENER) registers investment projects related to exploration and extraction activities with the Investment Unit of the Ministry of Finance and Public Credit (Secretaría de Hacienda y Crédito Público, SHCP) when public funds are required. The National Energy Commission (Comisión Nacional de Energía, CNE) provides technical support for validating regulatory aspects and sectoral feasibility.

Transportation and Logistics

For transportation, storage, or distribution projects that require funding from the Federal Expenditure Budget (Presupuesto de Egresos de la Federación, PEF), SENER prepares and submits the investment portfolio registration request to the SHCP’s Investment Unit. The CNE validates the technical, regulatory, and network integration criteria. In the case of private projects, registration and operational authorization are carried out directly before the CNE, in accordance with the applicable regulatory framework.

Refining

SENER submits the investment portfolio registration request for industrial transformation projects that require funding from the Federal Expenditure Budget to the SHCP’s Investment Unit. The CNE participates by issuing technical and regulatory opinions that support project evaluation. For private projects, registration and monitoring are handled by the CNE as part of the permitting process.

Exploration and Production

Projects requiring federal budgetary resources must be reviewed by the Ministry of Energy (Secretaría de Energía, SENER), based on technical recommendations provided by PEMEX, which determines their inclusion in the Federal Expenditure Budget (Presupuesto de Egresos de la Federación, PEF).

Transportation and Logistics

The National Energy Commission (Comisión Nacional de Energía, CNE) is now the authority responsible for granting, modifying, or revoking permits for the transportation, storage, distribution, and marketing of oil, natural gas, and petroleum products—including ethane, propane, butane, and naphtha—when transported via pipelines or other regulated means. SENER retains the authority to prioritize strategic sector projects, particularly those with budgetary implications or an impact on national energy security.

Refining

Refining projects that require federal budgetary resources must be analyzed by SENER, taking into account technical recommendations from PEMEX and regulatory guidelines issued by the CNE. This prioritization allows for their potential inclusion in the PEF, depending on their strategic relevance, operational efficiency, and supply capacity.

Exploration and Production

The National Energy Commission (Comisión Nacional de Energía, CNE) has the authority to grant permits and authorizations for surface reconnaissance and exploration activities.

Transportation and Logistics

For projects requiring public funding, the Ministry of Energy (Secretaría de Energía, SENER) evaluates their alignment with the objectives of the Sectoral Energy Program (Programa Sectorial de Energía), with technical support from the National Natural Gas Control Center (Centro Nacional de Control del Gas Natural, CENAGAS) and the CNE. These institutions contribute to determining whether the projects should be included in the draft Federal Expenditure Budget (Presupuesto de Egresos de la Federación, PEF). In the case of private projects, the CNE is responsible for issuing the corresponding permits for the development of transportation, storage, and distribution infrastructure for hydrocarbons, including the applicable technical, operational, and regulatory conditions.

Refining

The CNE has the authority to grant permits and authorizations for the industrial transformation of hydrocarbons, including the construction, expansion, and operation of refining facilities.

Exploration and Production

The promotion of investment projects in exploration and production activities is the responsibility of the Ministry of Energy (Secretaría de Energía, SENER), which presents them to potential national and international investors as part of the strategy to ensure the efficient use of the country’s energy resources.

Transportation and Logistics

Project promotion at this stage is led by SENER and the National Natural Gas Control Center (Centro Nacional de Control del Gas Natural, CENAGAS), with technical support from the National Energy Commission (Comisión Nacional de Energía, CNE). This effort includes publicizing investment opportunities, issuing public calls for proposals, designing private participation schemes, and presenting feasibility, demand, and interconnection studies to attract domestic and foreign investment.

Refining

SENER is responsible for promoting investment projects in hydrocarbon refining and industrial transformation, which are identified as strategic for strengthening national energy sovereignty.

Exploration and Production

The Ministry of Energy (Secretaría de Energía, SENER) is responsible for conducting bidding processes for the granting of assignments and contracts related to exploration and extraction activities, in accordance with the fiscal and economic terms established by the Ministry of Finance and Public Credit (Secretaría de Hacienda y Crédito Público, SHCP). The National Energy Commission (Comisión Nacional de Energía, CNE) participates as a technical advisory body, validating regulatory, operational, and planning compliance aspects. The terms of reference and bidding guidelines are published on the official websites of SENER and CNE.

Transportation and Logistics

The CNE is the authority in charge of conducting bidding processes for the transportation, storage, and distribution of hydrocarbons when these involve open-access infrastructure or the participation of public investment.

Refining

Not applicable, as only external parties other than PEMEX may participate in industrial transformation activities as investors. In such cases, SENER grants permits either to PEMEX or to private entities to carry out oil treatment and refining activities, as well as natural gas processing.

Exploration and Production

Investment projects in exploration and extraction can be financed through various sources, depending on their technical characteristics, contractual structure, and participation scheme. The main sources include public funds through the Federal Expenditure Budget (Presupuesto de Egresos de la Federación, PEF), financing from commercial or development banks, as well as capital contributed by developers, institutional investors, and private entities.

Transportation and Logistics

There are several sources of financing depending on the specific characteristics and financial structure of each project. These may include the PEF, commercial banking, developers, and institutional or private investors.

Refining

Refining and industrial transformation projects can be financed through developers’ own resources, commercial bank financing, investment funds, or co-investment schemes. Depending on the project, institutional investors, energy companies, and actors specialized in energy infrastructure may also participate.

Exploration and Production | Transportation and Logistics

These activities are carried out by PEMEX, operators, and/or awarded developers, under the supervision of the Ministry of Energy (Secretaría de Energía, SENER) according to the terms of the contract. During this stage, the projects are overseen by the National Energy Commission (Comisión Nacional de Energía, CNE) with regard to compliance with the technical, regulatory, and operational conditions established in the permits or contracts. SENER, in turn, monitors the alignment of the project with energy policy objectives, as established by applicable legislation and sectoral planning instruments.

Refining

These activities are carried out by PEMEX, authorized operators, and/or developers, under the supervision of the CNE and SENER.

Projects

Information on new projects (pre-investment, bidding and execution) and in operation within the Mexico Projects Hub platform, which at some stage of the project were considered investment opportunities and do not necessarily have Banobras / Fonadin participation.

New Projects

Projects in Operation

Banobras / Fonadin

Project Finance: In order to support the financing of infrastructure projects and public services, the Project Finance Unit structures financing supported by the granting of loans and guarantees to those projects developed as Public-Private Partnerships and which have their own source of payment from the exploitation of the concession or public contract or from the collection of the service in question. The Public-Private Partnership schemes may be Federal and/or Local, in their different modalities, such as: Concessions, Service Provision Projects (PPS) or Financed Public Works Contracts, among others.

Financing for States and Municipalities and Decentralized Public Organizations: The products and services are designed to meet the infrastructure needs of states, municipalities and their decentralized public organizations, in order to improve the quality of life of the population and increase competitiveness.

Infrastructure is a pillar of development, which is why Banobras has innovative products and services focused on contributing to regional development through the promotion of financial mechanisms to:

- Boost investment in infrastructure and public services.

- Promote the financial and institutional strengthening of states, municipalities and decentralized public agencies.

To this end, Banobras has the following financing schemes:

Products:

Project Development: Banobras offers services aimed at assisting public sector agencies and entities in the development of infrastructure projects.

Financial structuring of the project:

- Elaborate and/or update studies required by the Public-Private Partnerships Law.

- Support in the review of the bidding conditions and contract model.

- Assist in obtaining financing for the project.

- Assist in the registration process of the project in the portfolio of the Investment Unit of the Ministry of Finance and Public Credit (SHCP).

- Assist in dealing with any observations made by the SHCP Investment Unit.

- Support in the financial closing of the project.

The purpose of the Fondo Nacional de Infraestructura (Fonadin) is to serve as the Federal Public Administration’s coordination vehicle for infrastructure investment. Its operations are governed by the Policies, Bases, and Guidelines on Public Works and Related Services of the National Infrastructure Fund, ensuring transparency and efficiency at every stage. It has one of the largest road concession networks in the world and manages the granting of financial support for infrastructure development, mainly in the areas of communications, transportation, water, environment, energy, tourism, urban and strategic and priority areas, supporting the planning, promotion, construction, conservation, operation and transfer of infrastructure projects with social impact and economic or financial profitability.

It has a wide range of products designed to strengthen the financial structure of the infrastructure projects that the country requires, from the conception to the completion of the projects, providing the following financial instruments that make the projects more attractive for financing with private resources:

Recoverable Support

- Simple Credits

- Subordinated Credits

- Guarantees

- Investments in Venture Capital Funds

- Infrastructure Trust Investments

- Financing of Studies and Advisory Services

Non Recoverable Support

- Contributions for Studies and Consultancy

- Contributions for Projects

- Project Grants

Contact: fonadin.energia@banobras.gob.mx

Sustainability

Banobras makes available to interested parties, analysis sheets for the detection of sustainability practices in infrastructure projects, in accordance with the methodological framework “Attributes and Framework for Sustainable Infrastructure” of the Inter-American Development Bank (IDB). Its objective is to highlight sustainable practices, encourage their adoption in future projects and provide relevant information for investors in their economic, environmental, social and institutional dimensions.

To consult the projects that already have a sustainability record, select the “SEARCH CRITERIA>” option in the PROJECTS section, and then select “With Sustainability Analysis”; the projects that have a record will be displayed below.

In addition, Banobras offers an analysis tool that presents the potential relationship of the different infrastructure projects of the Mexico Projects platform with the 17 Sustainable Development Goals (SDGs) of the 2030 Agenda and their targets. This comparative analysis facilitates the use of data according to different criteria, such as the potential impact of projects and sectors against national and global development goals.

The comparison is only made between projects in the same subsector. To select and consult here.

The alignment of a project with the SDGs provides information on the degree of focus on sustainability; it provides a comparison between projects in the same sector and sub-sector and facilitates investment decisions, showing the highest and lowest alignment of projects to the SDGs. Comparative analysis facilitates the use of data according to different criteria, such as the potential impact of projects and sectors against national and global development goals.

In the case of the sector, 27 projects are identified in the platform that have sustainability practices detection sheets, which allows to know, among other things, the projects with more and better alignments to the SDGs. For more information, access the Sustainable Development Goals application:

Greater alignment of the sector:

- SDG 9: Industry, innovation and Infrastructure

- SDG 8: Decent Work and Economic Growth

- SDG 11: Sustainable Cities and Communities

Lower alignment of the sector:

- SDG 2: Zero Hunger

- SDG 5: Gender Equality

- SDG 10: Reduced Inequalities

Ally Networks

Banobras, through its Ally Networks application, provides information on companies participating in competitive public procurement processes for infrastructure projects in Mexico, based on official sources such as ComprasMX. It includes details on investment amounts, number of participations in bids, projects awarded, consortiums, and business associations, which allows the user to identify potential actors for the establishment of investments in the country.

To consult the projects that have information on the participating companies, select the option “SEARCH CRITERIA>” in the PROJECTS section, and then select “With applicant companies” at the end of the criteria.

In the application, you can consult on the sector:

- 106 projects

- 197 companies

- 177 consortiums

- 106 Projects

- 197 Companies

- 177 Consortiums

Reference documents:

This section offers documents, reports and reports with technical, statistical and regulatory information on the sector:

Official statements:

2026

- 02/04/2026 PRESIDENCY: Pemex increases crude oil processing to 1.5 million barrels per day; reduces debt by $20 billion and increases investment by 34% in 2026

- 01/06/2026 DOF: NOTICE announcing the electronic addresses where the Policies, Bases, and Guidelines on Public Works and Related Services of the National Infrastructure Fund may be consulted.

2025

- 12/03/2025 DOD: DECREE issuing the Regulations of the Law of the State Public Enterprise, Petróleos Mexicanos.

- 10/20/2025 DOF: Guidelines for the preparation and presentation of costs, expenses, and investments; the procurement of goods and services; and the accounting review of Mixed Contracts.

- 10/03/2025 DOF: Regulation of the Hydrocarbons Sector Law

- 10/03/2025 DOF: Regulation of the Biofuels Law

- 10/03/2025 DOF: Regulation of the Energy Planning and Transition Law

- 10/03/2025 DOF: DECREE amending and repealing various provisions of the Regulation of the Hydrocarbons Revenue Law

- 08/05/2025 Presidency: Strategic Plan 2025–2035: Progress in the recovery of Pemex, the people’s company of Mexico

- 07/31/2025 DOF: NOTICE announcing the electronic addresses where the Guidelines for construction and service projects developed and financed by third parties for the State-owned enterprise Petróleos Mexicanos may be consulted.

- 06/24/2025 DOF: Agreement amending the Operating Rules of the Assignments, Contracts, and Permits Committee of the Ministry of Energy.

- 06/05/2025 DOF: Organic Statute of the State-Owned Enterprise, Federal Electricity Commission

- 05/22/2025 PEMEX: Organic Statute of the State-Owned Enterprise, PEMEX

- 04/29/2025 SENER: Agreement by which the deadlines and timeframes for the receipt and processing of matters under the jurisdiction of the Ministry of Energy are resumed, in accordance with the powers that were transferred to it.

- 04/25/2025 Mexican Petroleum (PEMEX): Guidelines for Mixed Development Schemes of the State-Owned Enterprise

- 03/18/2025 DOF: DECREE issuing the Law on State-Owned Enterprises, Federal Electricity Commission; the Law on State-Owned Enterprises, Petróleos Mexicanos; the Electricity Sector Law; the Hydrocarbons Sector Law; the Energy Planning and Transition Law; the Biofuels Law; the Geothermal Energy Law; and the National Energy Commission Law; amending various provisions of the Law on the Mexican Petroleum Fund for Stabilization and Development; and amending, adding, and repealing various provisions of the Organic Law of the Federal Public Administration.

- 03/18/2025 DOF: DECREE amending, adding, and repealing various provisions of the Hydrocarbons Revenue Law.

- 02/12/2025 PEMEX: Presentation of the 2025–2030 Work Plan.

- 01/29/2025 SENER: Secondary Legislation on Energy – PEMEX and CFE as Companies of the People of Mexico.

- 01/29/2025 Government of Mexico: CFE and PEMEX are once again of the people of Mexico: President signs secondary legislation that reverses the 2013 energy reform.

2024

- 12/20/2024 DOF: DECREE amending, adding, and repealing various provisions of the Political Constitution of the United Mexican States, regarding organizational simplification.

- 10/31/2024 DOF: DECREE amending the fifth paragraph of Article 25, the sixth and seventh paragraphs of Article 27, and the fourth paragraph of Article 28 of the Political Constitution of the United Mexican States, regarding strategic areas and state-owned enterprises.

Additional information:

2024

- PEMEX: Oil Revenue for Wellbeing.

- PEMEX: Strategic Guidelines for the 2024–2030 Period.

- SENER: 2024 Evaluation of the Execution of the Five-Year Bidding Plan for Hydrocarbon Exploration and Extraction 2020–2024.

- SENER: Active Permits for the Production, Commercialization, and Transportation of Bioenergetics by Means Other Than Pipelines.